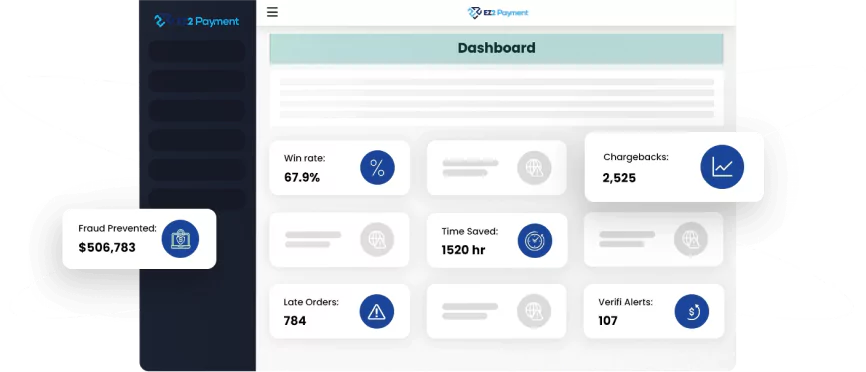

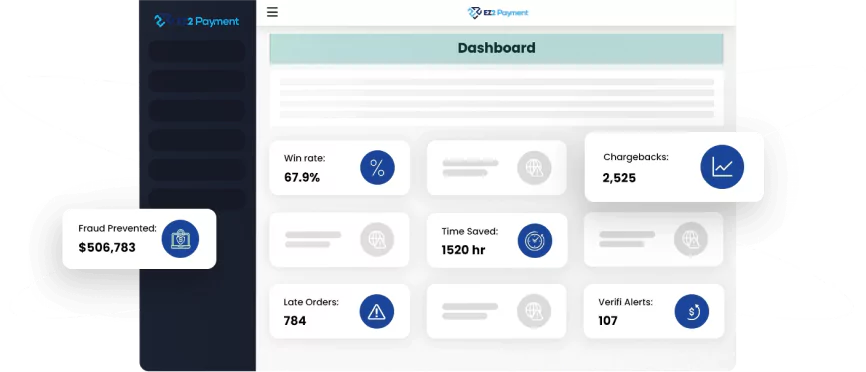

Fraud Detection Software Built to Prevent Revenue Loss

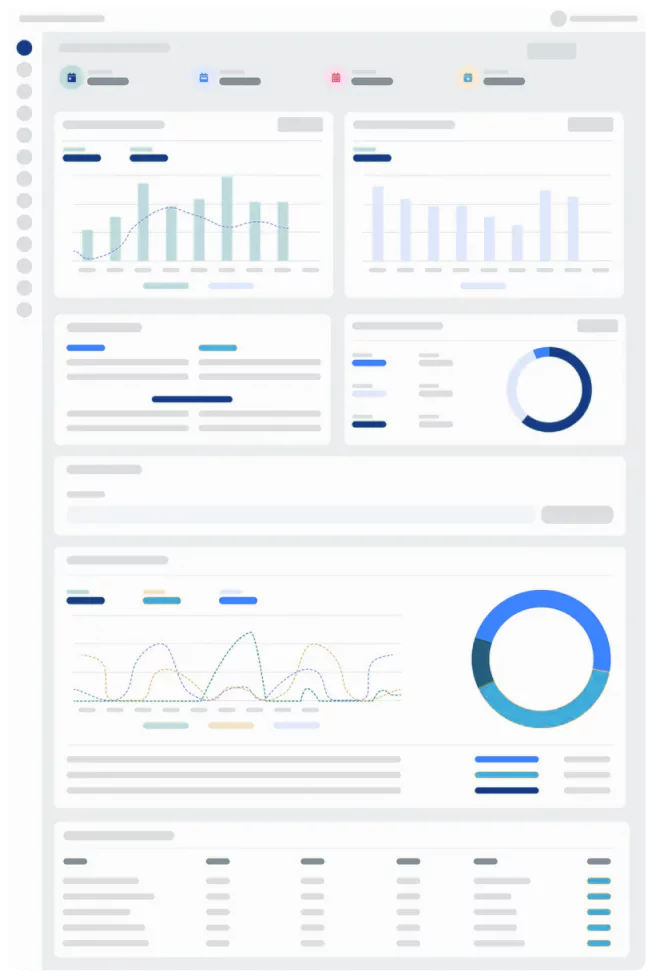

Want to prioritize revenue growth and worry less about fraud? EZ2 Payment is here to help. Our fraud prevention solution stops threats in real time and improves business operations so you can focus on increasing revenue.