What are Chargebacks Really Costing You?

Beyond the lost sales revenue and the cost of the merchandise, each

dispute will also Mean incurring ancillary expenses. These include chargeback

fees, administrative costs, And overhead expenses like shipping, fulfillment,

and customer acquisition costs.

Other Sources of loss, such as false declines and return fraud, will also likely

increase. When you account for all these additional expenses, the price of

chargebacks spirals Quickly. One study shows that, on average, merchants

ultimately lose $3.75 for every Dollar disputed.

Prevent Chargebacks by Instantly Resolving Customer Disputes

Resolve customer disputes before they become chargebacks. Use integrated preventionalerts to refund customers, stop order fulfillment, and cancel subscriptions—all from within the EZ2 platform.

Customer Disputes Transaction

A customer contacts the bank and disputes a transaction. The bank collects the customer's information and the dispute resolution process begins.

Prevention Alert Triggered

The bank sends a notification of the dispute through the appropriate prevention alert network. EZ2 receives the alert and notifies you of the customer dispute.

Prevention Alert Resolved

You have the chance to refund the disputed transaction and resolve the customer's issue before it progresses to a chargeback.

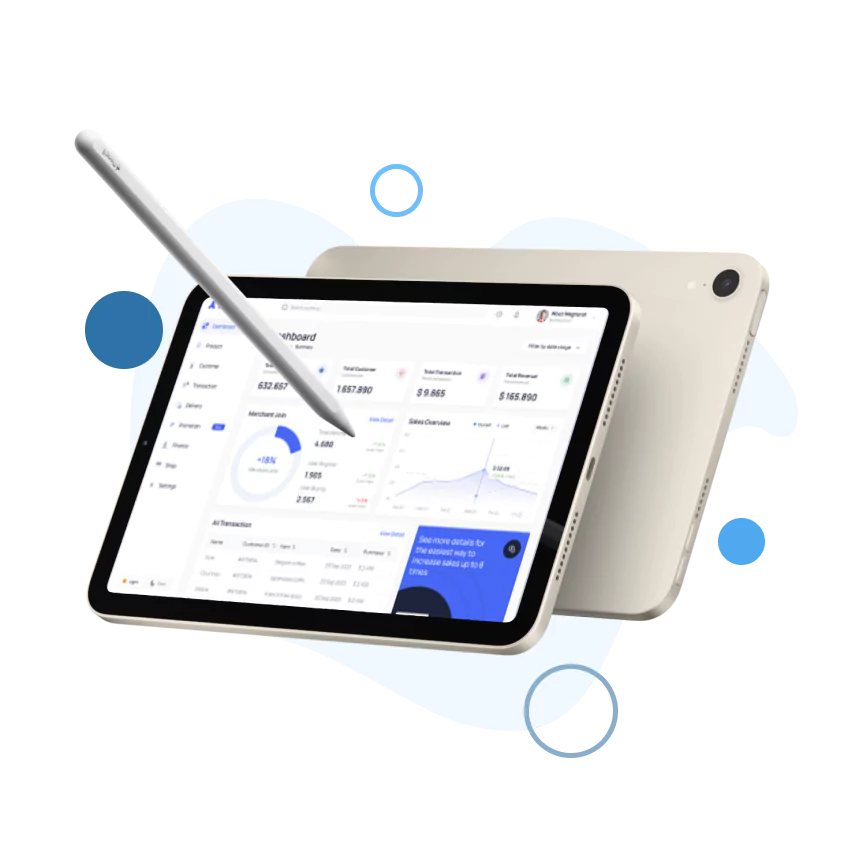

Sync Your Order Information with Your Payment Processing Data

Add order information to merchant account data inside EZ2 Payment Gateway. Then, all the tools you need to prevent chargebacks will be easily accessible from a single platform.

What Are Chargeback Alerts?

A chargeback alert is an advance warning from an issuer, facilitated by a third-party provider. The alert informs the merchant when a chargeback is pending, but has not yet been filed. This gives the merchant time (between 24 and 72 hours) to refund the disputed transaction and avoid the chargeback.

The Process

Discover Chargeback Trends with Prevention Alert Analytics

Marketing Source

Stop spending money on marketing and advertising campaigns that trigger more disputes than profits. Discovers low quality customers.

Price Point

Run A/B tests to determine which price points are causing the most disputes. Balance revenue with costs to optimize profitability.

Subscription Cycle

Determine which billing cycle is triggering the most disputes. Act quickly when customer loyalty and perceived value start to drop.

Product Type

Discover which products are popular targets for criminals and friendly fraudsters. Know which merchandise is highly susceptible to disputes.

Discover Chargeback Trends with Prevention Alert Analytics

Analyze early-indicator data from prevention alerts paired with order information to identify future chargeback trends. Solve issues up to five weeks sooner and minimize revenue loss.

learn moreReal-Time Merchant Account Monitoring

Easily monitor your chargeback situation in real time, be notified the moment risk starts to increase, and take preemptive action to keep your merchant account healthy and profitable.

REAL TIME NOTIFICATIONS

Set custom triggers and receive notifications any time account activity reaches one of your predetermined thresholds. No more logging into multiple portals, waiting for reports, or constantly monitoring your chargebacks. EZ2 doesn’t sleep so you can.

REAL-TIME REPORTING

Use real-time data to gain a realistic understanding of your current situation and what needs to happen in the future. EZ2 removes the barriers to highly-valuable and insightful information so you can make intelligent, data-driven decisions.

Payments, Powered by People

Let a EZ2 Payments Expert show you how the Global Payment Orchestration Platform could improve your bottom line.

Talk to a Payments Expert